Intraday trading involves buying and selling assets within a single day. The global financial markets are very active and present several daily trading opportunities. The advantage of intraday trading is that it does not involve any overnight costs. Traders use candlestick charts and technical indicators to identify patterns to predict future price movements of instruments they are trading in. Based on these, traders develop strategies for trading forex, stocks, indices, precious metals, and CFDs. Scalping is one of the most popular strategies traders use to take advantage of volatility in the global finance markets.

What is Scalping?

Scalping is a trading strategy that involves placing several small trades throughout the day. The aim is to earn small profits across instruments, which add up to a meaningful amount. Scalpers place a large number of trades every day, rather than carrying a couple of trades with the aim of earning big profits. The key to successful scalping is understanding short-term charts (ten seconds to five minutes) and correctly identifying the trading patterns.

Some things to remember when using scalping as a trading strategy:

- This is a very high-frequency trading. Experienced traders hold positions for a few seconds or minutes.

- The goal is not to make one big trade, but multiple small trades.

- It requires swift decision-making and a good understanding of technical indicators and chart patterns.

- Scalping strategies are based on charts for smaller durations.

- This strategy is most suitable for markets that tend to be volatile yet have low spreads, like equities, stock indices and major currency pairs.

- Scalping requires discipline and the ability to control emotions when trading.

Popular Scalping Strategies

Scalping works on the principle that smaller moves are more frequent in a day and can be easily identified. It is based on the belief that a lower duration exposure to the markets lowers the risk of losses. Some popular scalping strategies that can be used for intraday trading are:

#1 – Moving Averages

While you can use simple moving average (SMA), it’s better to use exponential moving average (EMA) for scalping. This is because EMA focuses on the most recent price movement and gives you more detailed information.

5-20-100 MA

You can combine three MAs – the 5 period, 20 period and 200 period. If the 200 period one is rising, look out for when the 5 period MA crosses above the 20 period one. When this happens, you can take long positions. Conversely, if the 200 period MA is declining, it’s time to wait for the 5 period MA to cross below the 20 period one.

9-21-55 EMA

You may also combine the 9 period, 21 period and 55 period EMA. Here, if the 9 period line crosses over the 21 EMA but remains above the 55 period one, it suggests a good time to take long positions. On the other hand, if the 9 EMA crosses below the 21 and 55 EMA lines, it signals a downtrend and good shorting opportunity.

MACD

The Moving Average Convergence Divergence (MACD) shows the relationship between two moving averages. The MACD line is calculated by subtracting the 26 period EMA from the 12 period EMA. A 9-day EMA of the MACD line is called the signal line. When MACD crosses the signal line from below and moves higher, it is considered a time to go long. If, on the other hand, the MACD line crosses the signal line from above and moves lower, traders see this as a good time to short the asset.

Source: https://www.investopedia.com/terms/m/macd.asp

#2 – Parabolic SAR (Stop and Reversal)

This indicator appears as a series of dots on the chart. If these dots appear below the price, it indicates an ongoing uptrend. Similarly, the dots appearing above the price indicate the price is moving down. A change in the position of the dots indicates a potential reversal of the trend.

This can also be combined with the 200 period moving average. It confirms an uptrend if the Parabolic SAR dots are below the price and above the 200 MA. Conversely, Parabolic SAR dots being below the price of 200 MA confirms the sell signal.

Source: https://www.investopedia.com/trading/introduction-to-parabolic-sar/

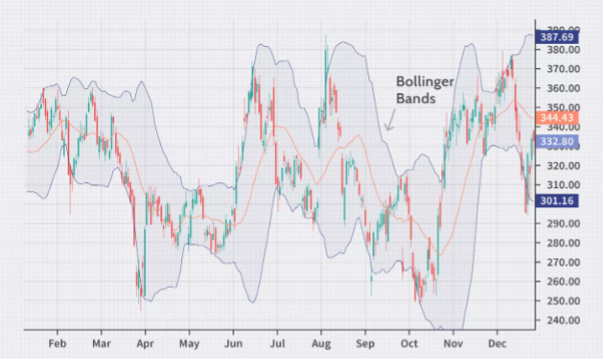

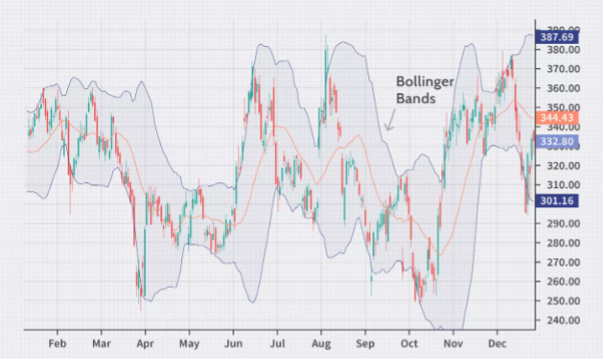

#3 – Bollinger Bands

Another popular scalping strategy makes use of the Bollinger Bands that comprise three lines – a moving average (middle line) and two lines based on the standard deviation + or – the 20-day simple moving average. This indicator is used to identify overbought and oversold levels that indicate the overall trend and a potential reversal of the trend.

If the price moves closer to the upper band, it signals an overbought market. An oversold market is indicated by the price reaching the lower band. This is the time when scalpers can enter the trade. Once the price returns to the middle line, it signals an exit. Stop loss order can be placed below the last swing low (in the case of a buy trade) or above the previous swing high (in case of a sell trade).

Source: https://www.investopedia.com/terms/b/bollingerbands.asp

#4 – RSI Indicator

This strategy involves using the RSI indicator to identify overbought and oversold conditions in the market which indicate potential reversals or retracements. The Relative Strength Index (RSI) measures price changes and their speed, guiding traders about the strength of the price action. A good trading strategy is to use this indicator to look for possible trend reversal.

An asset is considered overbought when the RSI is above 70 and oversold when it is below 30.

Source: https://www.investopedia.com/terms/r/rsi.asp

While these indicators provide buy and sell signals, it is best to use risk management techniques when scaping. The best risk management for scalpers includes keeping the position sizes small, diversifying trades across markets, setting appropriate stop-loss orders, and monitoring market conditions.

To Sum Up

- Scalping is an excellent strategy for intraday traders but requires practice in using technical charts and indicators to identify entry and exit points.

- Scalpers focus on placing a large number of small traders rather than trying to make big profits from just a few trades.

- This strategy is most suitable for volatile markets, as ranging markets offer few trading opportunities.

- Moving averages and Parabolic SAR help indicate the ongoing trend in the market.

- Bollinger Bands and RSI indicate overbought and oversold conditions.

- Good risk management techniques are even more important for high-frequency trading.

Disclaimer:

All data, information, and materials are published and provided “as is” solely for informational purposes only and are not intended nor should be considered, in any way, as investment advice, recommendations, and/or suggestions for performing any actions with financial instruments. The information and opinions presented do not take into account any particular individual’s investment objectives, financial situation, or needs, and hence do not constitute as advice or a recommendation with respect to any investment product. All investors should seek advice from certified financial advisors based on their unique situation before making any investment decisions in accordance to their personal risk appetite. Blackwell Global endeavours to ensure that the information provided is complete and correct but make no representation as to the actuality, accuracy or completeness of the information. Information, data, and opinions may change without notice and Blackwell Global is not obliged to update on the changes. The opinions and views expressed are solely those of the authors and analysts and do not necessarily represent that of Blackwell Global or its management, shareholders, and affiliates. Any projections or views of the market provided may not prove to be accurate. Past performance is not necessarily an indicative of future performance. Blackwell Global assumes no liability for any loss arising directly or indirectly from use of or reliance on such information herein contained. Reproduction of this information, in whole or in part, is not permitted.