Investors and traders have been closely tracking bond yields this year. This is because, in March 2021, the yield of US 10-year Treasury bonds moved to 1.74%; a level it hadn’t matched since January 2020. Let’s look at why this happened and their relationship between bond yields and currencies.

Why Did US Bond Yield Rise?

When the pandemic began in March last year, the Federal Reserve lowered its benchmark interest rate. This was to prevent restrictions from crippling economic output across sectors. The Fed has no intention of raising rates, as long as inflation remains below the 2% mark. However, with inflation rising this year, investors became nervous about possible rate hikes; they responded by selling off fixed income positions that favour higher-yielding assets. This caused treasury prices to drop and, consequently, yields to rise.

After a period of rising yields, they did cool off from the 1.74% high. With the Fed reassuring markets that they would keep inflation under control without raising interest rates.

How Did the US Dollar Respond?

Pandemic-hit 2020 was one of the most volatile years for the US dollar. The currency crashed in March 2020 as infections climbed. Despite that, investors rushed to add US dollars to their portfolio, given the greenback’s safe-haven appeal. The US Currency Index (DXY) spiked 8% from its March 9th lows to a high of 102.99 on March 20th. Following doubts around the virus waves, vaccine rollouts and a global economic recovery led to tremendous US dollar volatility.

When the US Treasury yields hit highs in March 2021, DXY mirrored the rally, rising from 90 to 93. Is there a link between the rally in the US dollar and the Treasury market? How should forex traders set positions when treasuries fluctuate?

Correlation Between Bond Yields and Currencies

Economic Activity at the Centre of the Equation

The demand for a currency is linked to the performance of the domestic economy. A stable economy with a mature capital market will attract more foreign investments; this increases demand for its currency. Traders will also sell their other currency holdings to gain exposure to that currency; this boosts demand for the currency and its exchange rate.

Take for example what happened to the EUR/USD pair in 2019. The Euro was troubled by lessened forces from its member nations. A recession in Italy, the widespread Gilet-Jaunes protests in France, and the uncertainty of prolonged Brexit negotiations made the Eurozone less attractive. Germany, the primary driver of the EU economy, barely managed to expand; posting GDP growth of just 0.6% in 2019 (down from 2.5% in 2017 and 1.5% in 2018). All these factors caused the EUR/USD to decline through the year, and the pair ended 2019 having lost 3.6%.

The domestic economy also influences the central bank’s monetary policy and interest rate decisions. When economic activity is low, central banks attempt to stimulate the flow of money. This monetary easing is done through purchasing government treasuries and other securities (like corporate bonds). This increases bond prices, which exerts pressure on bond yields (which is calculated by dividing the bond’s coupon payments by its market price). It also increases the supply of money in the economy, which exerts pressure on its exchange rate.

On the other hand, central banks raise interest rates as the economy revives from a recession. This is done to prevent overheating and high inflation rates. As the central bank raises interest rates, both bonds yields and the currency’s exchange rate also began to climb.

Direct Relationship between Bond yield and Currencies

While the state of the economy is a major link between yields and forex rates, a more direct relationship stems from investing activity. Higher bond rates and lower bond prices attract investments from other regions, boosting the country’s currency. The difference in the interest rates between two countries defines the appeal of owning and holding one country’s treasury over another. This difference incentivises investors to borrow money in a low-rate environment and invest in a high yielding one. This strategy, known as carry trade, can be a major factor of currency movements.

What Do All These Mean for Forex Traders?

Forex traders are not as concerned with the present price level of the currency. Rather they are interested in how it might move in the near future. Forex traders can predict how currencies might move by monitoring yield spreads or rate differentials.

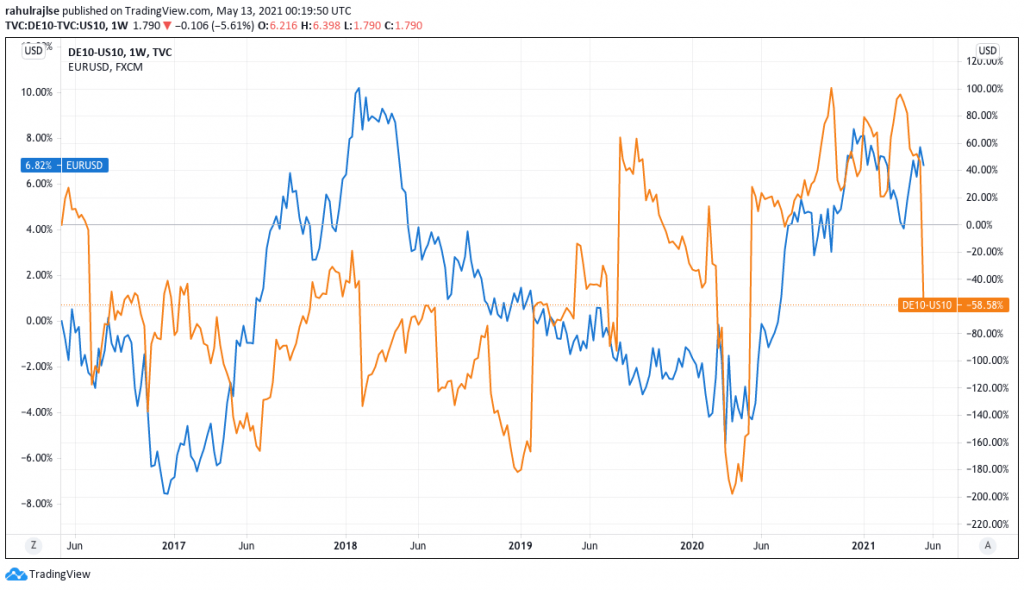

10Y German – 10Y US Yield Spreads (5y history) v EURUSD %gains – Image Source: Trading View

The image shows the interest rate differential on the German 10-year Bond and the US 10-year Treasury, plotted against the EUR/USD forex rates. We can see that changes in the interest rate differential often lead to similar changes in the forex rate. A higher German Bond interest rate attracts foreign capital; this boosts demand for the euro, leading to an appreciation in the EUR/USD pair.

Important Things to Bear in Mind

Traders should remember, that while Germany is an important driver, the euro is also influenced by the other EU economies.

Remember that the US dollar enjoys additional demand for being a safe-haven asset. This special status is a combination of two factors – the low perceived default risk of the US treasury and the greenback being an international reserve currency. Many contracts globally are denominated in USD, which has resulted in the dollar having resilient organic demand from businesses.

The third thing to note here is that forex rates are based on various other factors, including organic demand for the currency during trade between countries, macroeconomic factors, and speculation in the forex market. For instance, investments in Australia and consequently the appreciation in the Australian dollar over the last decade had little to do with the country’s current low interest rates and more to do with the attractiveness of the country’s mining sector. Also, in the modern globalised economy, forex appreciation can depend on external growth, as evidenced by the US dollar’s weakness due to growing US demand for imports and weak global demand for American exports.

These other factors can cause interest rate differentials and bond yields to diverge from forex rates. The extent of divergence will depend on how much demand for the currency the interest rate differential generates and how persistent the other factors are.

Forex traders can consider bond yields and interest rates as informative signals of currency movements, while forming a more holistic picture by taking into account the other drivers too.

References

Financial Times, TradingView, DW, Finance Yahoo.

Start Trading in 3 easy steps

1

Complete the Application Form

It takes just minutes for us to verify your identity and set up your account.

2

Download MT4 Platform

Download MT5 and trade via your desktop, mobile or tablet. No minimum deposit required.

3

Start Trading

Trade more than 60 products (Forex, CFDs & Commodities)