Butterfly harmonics summons up a beautiful image of a spring meadow, with butterflies fluttering over blooming daisies, while soft music plays in the background. Wake up! We are talking about forex trading. There are no butterfly wings here at all. What you do have is a family of highly useful harmonic trading patterns that help forecast market turning points by working with Fibonacci sequences.

However, butterfly harmonics is just as fascinating as the lepidopterans they derive their name and appearance from. They can help you make sense of the forex market in a big way. Let’s find out how.

Structure of Butterfly Patterns

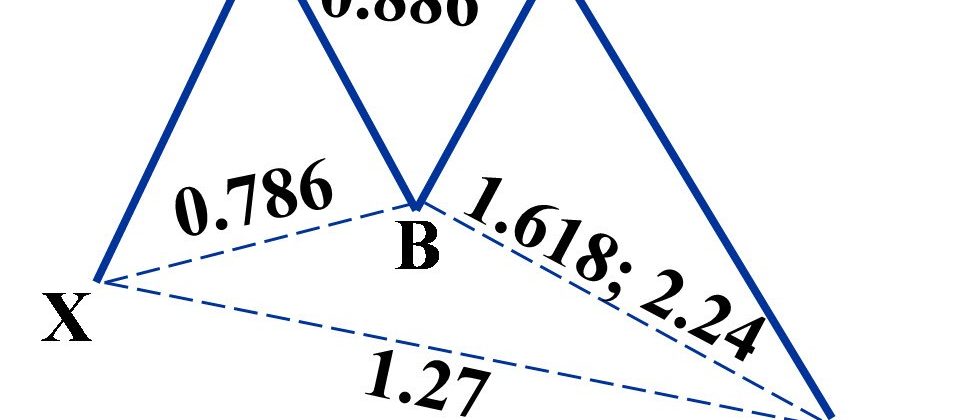

A typical butterfly pattern is an evolved form of the older Gartley harmonic pattern. There are four legs, or price moves, with different retracement levels, and are based on the typical ABCD template. The legs are marked at X-A, A-B, B-C and C-D.

- AB: Opposite the XA leg, this leg should ideally be 0.78 times the XA leg.

- BC: This leg is opposite the AB leg and is generally either 0.382 or 0.886 times the length of the AB leg.

- CD: This is the last price move and is found opposite BC. It is generally 1.62 times the length of the BC leg, when the latter is 0.382 times the AB leg. In case BC is 0.886 times the length of AB, CD should be 2.62 times the length of BC.

- XA: This leg can be any move on the harmonic pattern.

For a signal to be valid, there must be an AB = CD pattern, where the extended CD leg is 1.618 or 1.27 times longer than the AB leg. This pattern is also called an extension pattern because the D leg extends beyond the original XA leg.

Differences between Butterfly Patterns and Gartley Patterns

Butterfly patterns are a modified version of the older Gartley patterns, and, therefore, look pretty much the same. Both have 5 points and 4 legs, look visually similar, and are traded in a similar manner. However, unlike the Gartley, the butterfly is considered an extension pattern, and not a retracement one. This is because the point D in the butterfly extends beyond X, the starting point.

The reason why traders are more excited about butterfly patterns is that they indicate sharper reversals, and, consequently, higher success rates.

Trading with Butterfly Harmonics

Before you can start trading using the butterfly pattern, a few key elements should be checked:

- AB = CD or an extension of this

- A Fibonacci extension of 127% for the XA leg

- A Fibonacci extension of 161.8% or 261.8% for the BC leg

For bullish patterns, identify the end of the pattern at point D. This is generally an extension of 127% of the XA leg. You need to place a buy order at this point. Now, below a Fibonacci extension of 161.8% of the XA leg, stop loss can be placed. When it comes to placing your profit target, it depends on both market conditions and your trading objectives.

For bearish butterfly patterns, the sell order will be placed at point D (a 127% extension of the XA leg). The stop loss will be positioned right above an extension of 161.8% of the XA leg. In both bullish and bearish patterns, placing the profit target at A is considered an aggressive move, and placing it at B, a defensive one.

On the whole, traders should look to use butterfly patterns with high-reward and low-risk trades. The best part about butterfly harmonics is that they are easy to trade, and the trade probability is highly reliable. And you can confidently say that you are trading the most beautifully named method in the industry.

Disclaimer

If you liked this educational article please consult our Risk Disclosure Notice before starting to trade. Trading leveraged products involves a high level of risk. You may lose more than your invested capital.