Purpose

This document provides you with key information about this investment product. It is not marketing material. The information is required by law to help you understand the nature, risks, costs, potential gains and losses of investing in this product and to help you compare it with other products

Product

CFD on Forex pairs.

Blackwell Global Investments (UK) Limited is a limited liability company registered in England and Wales with its registered office at 107 Cheapside, London, EC2V 6DN, United Kingdom. Company Number 09241171. Blackwell Global Investments (UK) Limited is authorised and regulated by the Financial Conduct Authority. Financial Services Register Number 687576. This document was last updated on January 2018

Website: www.blackwellglobal.com | Telephone number: +44207 193 4808| Email: [email protected]

Alert

You are about to purchase a product that is not simple and may be difficult to understand.

What is this product?

Type

This document relates to leveraged products known as ‘contracts for difference’, which are also known as CFDs. A CFD allows you to obtain an indirect exposure to an underlying asset such as a security, commodity, index and other asset types. This means you will never own the underlying asset, but you will make gains or incur losses as a result of price movements in the underlying asset.

FX is always traded in currency pairs (e.g. EUR/USD) and involves the simultaneous buying and selling of two different currencies. The first listed currency of a currency pair is called the “Base” currency and the second currency the “Quote” currency. The profit and loss will accrue in the “quote currency”.

The currency pairs we currently offer CFDs on are found at https://www.blackwellglobal.co.uk/forex/ .

Objectives

The objective of trading CFDs is to speculate on the price movement of a currency pair and your return depends on the movement in the price of the currency pair and the size of your position. For example, if you believe the EUR will increase in value in relation to the USD, you will buy a CFD on EUR/USD (also known as “going long”) with the intention of selling it later at a higher price. The difference between the price at which you buy and sell equates your profit minus any other costs (see details below). On the other hand if you believe that the EUR will decrease in value in relation to the USD, then you will sell a CFD on EUR/USD (also known as “going short”) with the intention of buying it later at lower price. The difference between the price at which you sell and buy equates your profit minus any other costs (see details below). However, in both circumstances, if the market moves in the opposite direction to the one you have predicted, you will suffer losses. Trading with leverage can magnify both the profits and losses you make in relation to the investment.

Leverage is a tool which multiplies your available balance. Trading with leverage allows you to open bigger positions since the margin required will be lowered according to the leverage you have chosen. Even though with leverage you can make a bigger profit, there is also a risk of having a bigger loss because the positions you open will be of higher volume (lot size). Our standard lot size value is the following: 1 Lot = 100,000 EUR.

Intended Retail Investor

CFDs are intended for investors who have knowledge of, or are experienced with, leveraged products and that understand how the prices of CFDs are derived, the key concepts of margin and leverage, the fact that losses may exceed deposits and have the appropriate financial means to bear losses of the entire amount invested. CFDs are also intended for investors who can allow themselves to take a high risk and intend to use the product for short-term investment and/or speculative trading.

Term

CFDs on FX generally have no expiration date or minimum holding period. You decide when to open and close your position(s). We may close your position(s) without seeking your prior consent if you do not maintain sufficient margin in your account.

What are the risks and what could I get in return?

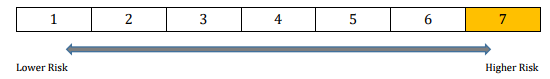

Summary Risk Indicator (“SRI”)

The summary risk indicator is a guide to the level of risk of this product compared to other products. It shows how likely it is that the product will lose money because of movements in the markets or because we are not able to pay you. We have classified this product as 7 out of 7, which is the highest risk class. This rates the potential losses from the future performance of the product at a very high level.

CFD trading requires you to maintain a certain level of funds in your account in order to open position(s) and to keep your position(s) open. This is called the initial margin and maintenance margin respectively.

Spreads may vary and the CFDs prices may be subject to high volatility that can generate losses rapidly. Therefore, a CFD is a leveraged product that due to underlying market movements can generate losses rapidly.

Currency risk

Be aware of currency risk. The final return of a CFD contract denominated in a currency other than your account currency is affected by both the performance of the CFD price rate and the exchange rate between both currencies. This risk is not considered in the indicator shown above.

Performance Scenarios

The scenarios shown below illustrate how your investment could perform. You can compare them with the scenarios of other products. The scenarios presented are an estimate of future performance and are not an exact indicator. What you get will vary depending on how the market performs and how long you keep the investment/product.

The table below shows the money you could get back under different scenarios, assuming that you sell 1 lot of EUR/USD, value of 100,000 EUR at 1.20000 and your position is closed on the same day. Leverage used is 100:1 – i.e. 1% initial margin requirement = 1000 EUR (100 000 × 1%). Profit and loss accrues at $10 for every 0.0001 movement in the underlying price. The position is closed on the same day.

| Long Performance Scenario | Closing Price | Price Change | Profit/Loss in USD |

| Favorable | 1.21200 | +1% | ((1.212-1.2) × 100,000) = 1,200 Profit |

| Moderate | 1.194 | -0.5% | ((1.194-1.2) × 100,000) = -600 Loss |

| Unfavorable | 1.188 | -1% | ((1.188-1.2) × 100,000) = -1,200 Loss |

| Stress | 1.14 | -5% | ((1.14-1.2) × 100,000) = -6,000 Loss |

The figures shown include all the costs of the product itself excluding commission and other fees which can be found at the section Forex in the Company’s website. The figures do not take into account your personal tax situation, which may also affect how much you get back.

What happens if the Company is unable to pay out?

If Blackwell Global is unable to meet its financial obligations to you, you may lose the value of your investment. However Blackwell Global participates in the Financial Services Compensation Scheme (‘FSCS’), which covers eligible investments up to 50,000 GBP per person, per firm. Further information on the FSCS can be found on their website.

What are the costs?

| One-off costs | Spread | The spread cost is the difference between the buy and the sell price

which are derived from our liquidity providers. It is charged at the opening of the trade. |

| Commission | This a fixed commission charged at the opening of the trade. This commission varies depending on the type of account. | |

| Currency conversion | A currency conversion spread will be charged each time for converting any realized profits, losses and/or other

fees that are denominated in a different currency to the currency in which your account is denominated. |

|

| Ongoing Costs | Swap (Daily Financing cost) | For every night that a position is held open, a swap charge is either added or

subtracted to/from your account. The longer the position is held, the more the costs will accrue. |

For further information regarding costs, please visit our website here.

How long should I hold it and can I take money out early?

A CFD position can be held for any duration, i.e. intra-day or for a longer period. The spread costs (when opening the position) are not correlated to the duration of the CFD trade, however swap charges are applied overnight for each day the position is carried over. You should monitor the product to determine when the appropriate time is to close your position(s). The position can be closed anytime during market hours.

How can I complain?

If you wish to submit a query/complaint, you can do it by sending an email to [email protected] . For more details please refer to our “Complaints Handling Procedure”.

Where we are not able to resolve your complaint to your satisfaction, you may be permitted to refer your complaint to the Financial Ombudsman Service.

Other relevant information

For further information on CFDs, please visit our website www.blackwellglobal.com.