Like deciphering the perfect crime by working backwards from the crime scene, there is a way to work out the strategy someone used to make a killing trade. The trick is to uncover the strategy they used and to do this means knowing all the details within the strategy and replicate it. This is where “Reverse Engineering” comes into use. Reverse engineering is the process of deconstructing an object in order to make its duplicate. So, what we do is start with the finished product and go backwards step by step to see how it was created and developed.

Reverse Engineer Trading Strategies work to trace the original path of a successful trading strategy by trying out different combinations of strategy logic. Although we may not be successful in finding the same logic as that used in the original strategy, we may come quite close to it.

The main purpose of these types of trading strategies is to learn the methodology that has been tested profitably and then work to improve on them.

Steps to Reverse Engineer Trading

The first and foremost step if you wish to use reverse engineering strategies is finding ideas that have been successful. The next step is to start analyzing them backwards to form strategies and keep on revising them until they prove to be profitable. So, how can you reverse engineer a forex chart?

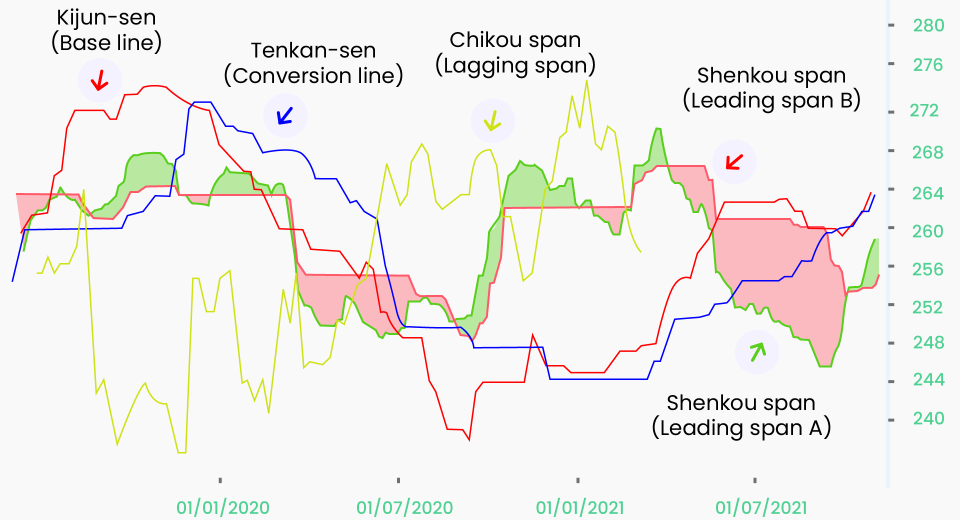

The process involves selecting a currency pair that you would like to trade and then add an indicator that you are familiar with or wish to learn. The next step is to observe the price patterns as they relate to the chosen indicator and formulate a strategy accordingly. Let’s take the case of a Simple Moving Average (SMA) indicator, which represents the average price of the currency pair over a specific period. You can check multiple SMAs across varying time periods to find a change in trend by using the moving average crossover strategy.

The next step is to interpret this trend. If the change in trend is to the downward side, you can place a sell order, and in the opposite scenario, a buy order can be placed. In some cases, you may need to look at additional indicators to come to a conclusion and then make a decision.

Also, one reverse engineering strategy may work only for one or a few currency pairs. Another point to note is that there are endless methods to reverse engineer a chart, and with them are endless opportunities to develop a new strategy and make successful trades. Practice or professional support will help you identify useful tools to successfully reverse engineer.

Key to Reverse Engineer Strategies

Successful trading in the forex market is not easy. It requires adequate and accurate information and its analysis before using the same in a systematic manner to make good trading decisions. Even when a trader wishes to use reverse engineer trading strategies, there has to be some idea about the strategy that you wish to emulate. Knowledge about some parameters provides a reasonable starting point and reduces the effort involved in finding the original path.

For example, if you come to know that a trading strategy was based on Moving Averages, you could go back and try out different combinations of the related charts. But if you have no idea about what type of tool was used for a strategy, you would need to make more guesses and spend a greater amount of time in trying to decipher the strategy used. Luck also plays an important role in reverse engineer strategies. If you are lucky, you may be able to guess early, and if you are not, you may need to keep on guessing and trying out various combinations for a long time.

So, reverse engineer trading strategies prove to be useful only when you know something important about a successful strategy. Secondly, what you know should actually be right. One also tends to improve their chances of successful reverse engineering by practicing and trying out different combinations or logic.

Disclaimer

If you liked this educational article please consult our Risk Disclosure Notice before starting to trade. Trading leveraged products involves a high level of risk. You may lose more than your invested capital.